Your enginnering Innovation Partner

We are a global technology partner specializing in advanced engineering and high-performance intelligent systems.

Our core focus is on providing high-quality Technical Outsourcing, delivering Software Development teams and individual engineering talent tailored to your needs.

We help organizations build robust, future-ready technologies. Our services also include Technical Due Diligence and team optimization to ensure your engineering operations are efficient, aligned, and built for long-term success

A specialized software consulting firm, we focus on delivering tailored technology strategies and development services across Europe.

With a hands-on, outcome-oriented approach, we support our clients through in-depth technical assessments, due diligence, and the design of strategic initiatives — including development roadmaps, team restructuring, outsourcing, and insourcing.

Based in Portugal and operating across Europe, we deliberately work with a limited number of clients to ensure deep engagement and high-impact results. This focus allows us to build strong partnerships and consistently deliver exceptional return on investment.

Our Offices

We are a remote-first team, but you can often find us in one of these places.

Avenida Duque de Loulé 12, 1050-090

Lisbon 🇵🇹

9, rue du Laboratoire L-1911

Luxembourg 🇱🇺

Rua Hermano Neves 18, Piso 3, E7, Lumiar, 1600-477

Lisbon 🇵🇹

Technical Due Diligence Services

We always start with a technical due diligence.

This consulting service culminates in a report that includes two main parts, one of them describing the current state of the project, while the second proposes changes directed to improve performance, reduce possible risks, and align technology with the business goals.

Technical Due Diligence for Fintech

Use Case

By conducting a technical due diligence, our team gained a comprehensive understanding of the partner’s current technological capabilities, potential vulnerabilities, and opportunities for improvement. This information was summed up in a detailed report that was presented to all stakeholders and served as a base to the further Tech strategy.

KYC and Anti-Money-Laundering

Use Case

The banking industry in general, faces numerous challenges related to customer onboarding, due diligence, and regulatory compliance. In this context, a state-of-the-art KYC system is essential to meet and anticipate the specific needs and requirements of the 🇱🇺 Luxembourgish banking industry.

EU Sustainability Taxonomy- Banking

Use Case

By implementing a Business Rules Engine, our team enabled non-technical employees to easily update EU compliance flows. This streamlined the process, reduced developer reliance, and improved efficiency, scalability, and auditability, forming the foundation for a more sustainable financial strategy.

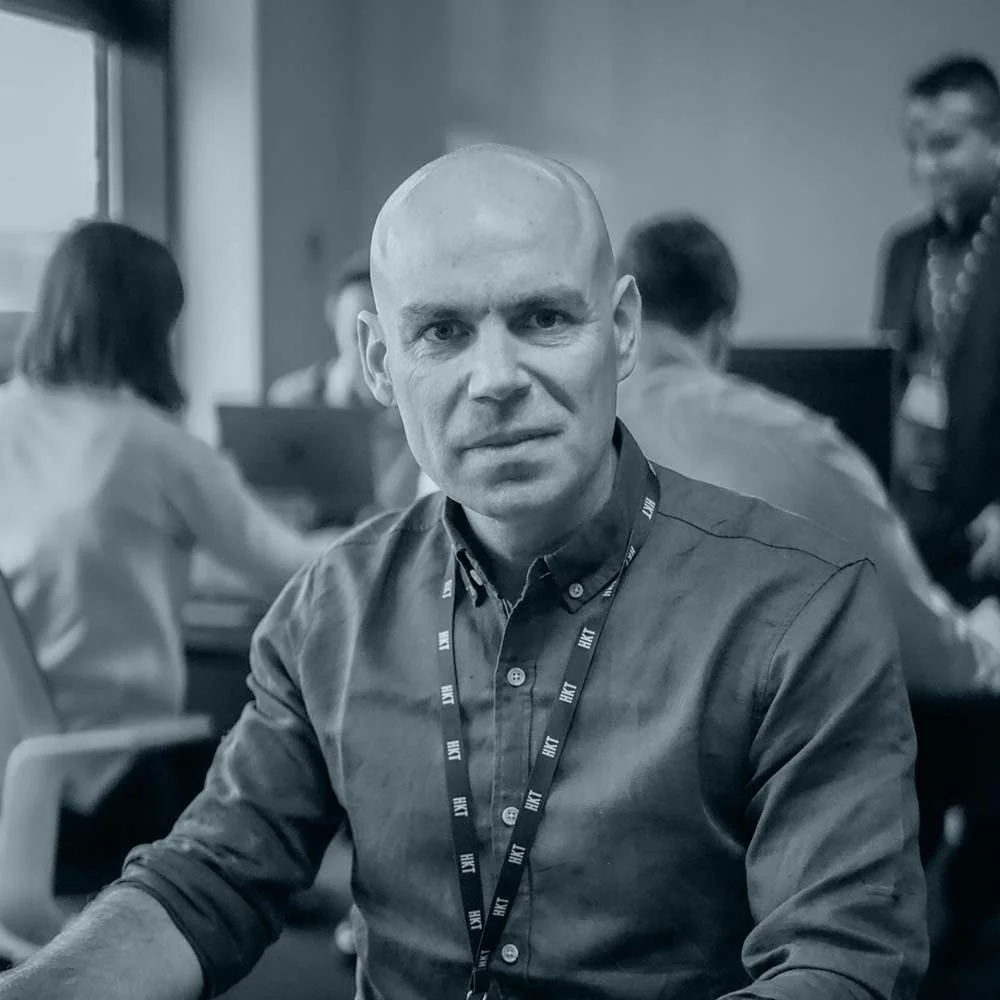

What clients say about us

Partners

Decent work and Economic growth

We embrace one of the 17 United Nations Goals to Transform the World by Fostering and Promoting development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and by encouraging the formalization and growth of micro-, small- and medium-sized enterprises, this goal has become core to what we do.

Schedule a Meeting

If you’re not certain how to get started, one of our specialists can guide you in a free consultation session.